Text João Barbosa | Translation Jani Dunne

My father was an artist, a painter. To him, investors were a hybrid of people with Diogenes Syndrome and speculators. However, this didn’t apply to all.

To visit a museum with my father was as fascinating as it was boring. With captivating words, he pointed out what many didn’t even notice. Then, he would gaze at a piece to soak up as much information out of it as possible, and turned…

– Father, will you take long? Can we move on to the next room now?

My father has pieces in many museums, private galleries and with a collection of investors. What annoyed him wasn’t the money, but the dark vaults and post mortem speculation.

Pablo Picasso in web.guggenheim.org

My friend (father) Manuel Jorge told us about Pablo Picasso children destroying a lot of his work after the Andalusian died, so that the value went up. He was shocked by the cynicism, opportunism, disrespect for the artist and, mostly, for the man.

He divided the investors into two groups: those who publicly displayed their work and those who kept it in vaults. He was hurt mostly by the latter – hurt is the right word.

He convinced me… partly. There is a bit of roguery in buying and capturing unique products whose value or interest aren’t respected, and the added value is what matters. Those are the signature buyers.

The biggest investors are experts and/or people who consult specialists. Yet, there are frauds. Not counterfeit – that crime is easy to spot – but fakes, original work that convinces the eye of excited specialists.

The same happens with wine as it does with art. I have no reservations regarding the business – just like my father – I think I was clear. The business exists – full stop.

I have a friend who surfs the wine business. He doesn’t cheat at all, only does what any businessman wants to do: buy early to get the best price and sell when there is added value.

He isn’t the only one; it’s a simple process and you “only” need initial capital. He buys Bordeaux, Bourgogne en primeur (while still in the barrel) and gets rid of them when the rate is profitable. He saves one or two bottles for himself and keeps the rest of the earnings to buy future harvests.

This buddy of mine is a “good” investor; he enjoys what he buys and makes a profit out of it. The “evil” in other investors is in the eye of the beholder.

Whether they are “good” or “bad”, they look for good deals. It’s good to know that some Portuguese wines are considered safe investments.

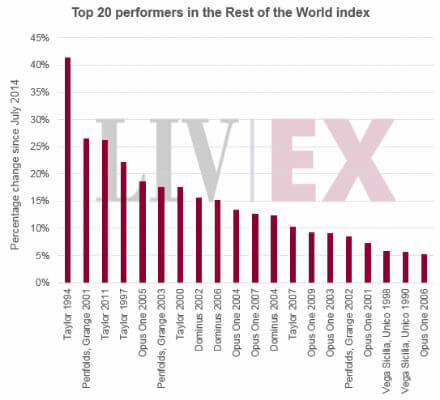

Top 20 Performers in the Rest of the World Index in www.blog.liv-ex.com

The Live-ex Fine Wine 1000 index, in The Drinks Business magazine, has been low, but Taylor’s pushed the sub-index Rest of the World 50 up by 3.2%. The Bordeaux gained 1.1% in value.

Taylor’s Vintage Port 1994 in www.taylor.pt

The most expensive wine in Rest of the World 50 is a Taylor’s, just like the third, fourth, seventh and thirteenth. Unfortunately, there are no other Portuguese wines within the top 20. The Vintage Port of 1994 by Taylor’s has been leading, having risen by 41.4% between July and February. Number 13 on the list, a Taylor’s 2007, went up in value by 10.3%.

Contacts

PO Box 1311

EC Santa Marinha

4401-501 Vila Nova de Gaia

Portugal

Tel: (+351) 223 742 800

Fax: (+351) 223 742 899

Website: www.taylor.pt

Leave a Reply